Fast and Accurate Reconciliation for Banks and Fintechs

Never lose a single penny with our automated reconciliation engine.

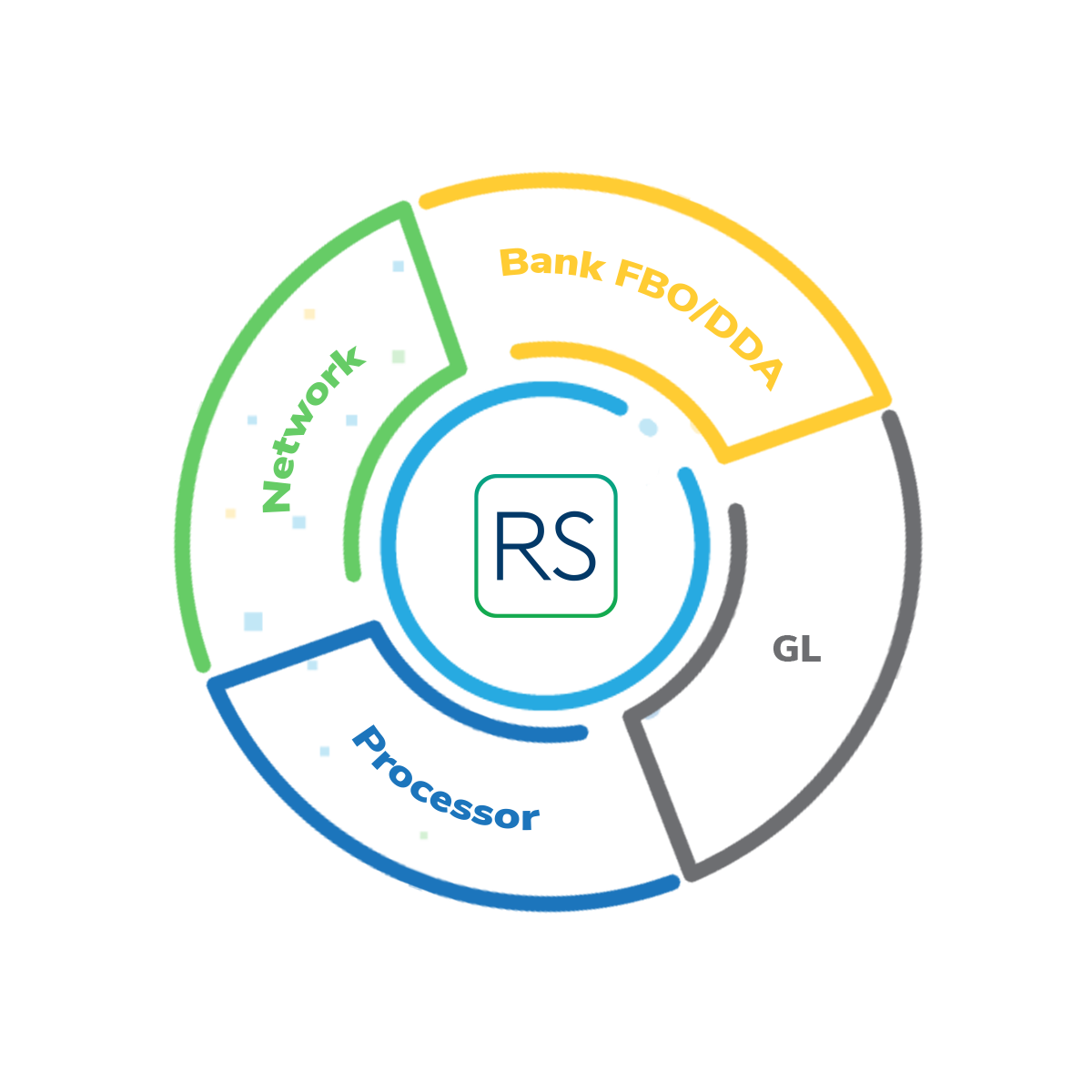

Automatically Reconcile DDAs, FBOs, GLs, and Merchant Payouts.

Reconcile All Transactions Between Networks, Banks, Cores, and Processors with ReconSeer

ReconSeer reconciles all transactions for multiple card programs, ACH, and all other transactions at an unprecedented speed. It handles all file formats and provides a vast offering of reports, all of which are accessed through a convenient dashboard.

Powerful Reconcilation Software

ReconSeer is a rule-based engine that oversees the reconciliation of cards and accounts at unprecedented speeds, ensuring financial accuracy data and effective money management. The DataSeers powerful reconciliation software for banks, payments companies, and Credit Unions balances accounts to the penny and moves money automatically with NACHA files. We provide Revenue Calculations. We can ensure your interchangeInterchange refers to the fees paid between banks for the processing of credit and debit card transactions. It plays a crucial role in the payment card industry’s functioning. More is paid out correctly by loading interchange tables. By providing Money Movement files/messages, we can ensure money moves properly across different accounts automatically.

3-Way Reconciliation

Account Exception Reports

MasterCard QMR

Visa QoC

QMR and QoC reporting

Transaction Matching

Revenue calculations

Automated Money Movement

Billing and Financial Reports

Call Reporting

Never Miss A Cent

ReconSeer is responsible for reconciling over $50 billion in payments spanning across several billion transactions (as of 2020). The DataSeers fast, accurate, and easy-to-use solution is powering some of the largest money movers in the world. CFOs can expect from ReconSeer the industry’s highest level of to-the-penny reconciliation.

- Visa Network Files (VSS)

- Mastercard network files (EBCDIC)

- ACH Files

- Wire Files/Messages

- RTP/FedNow Messages (20022)

- Bank/Core Files (BAI2)

- ProcessorA third party that is designated by a merchant to handle credit card and debit card transactions between that merchant and its customers. They are often broken down into two… More files from 50+ processors such as Galileo, Marqeta, FIS, Fiserv, i2c, etc.

FBO & DDA Recon

Is your processor telling you the correct information?

Our DDA recon ensures that the money in a customer’s account is properly reconciled. Whether you have one account or 100 million accounts, ReconSeer will sift through data at scale and provide you with crisp reporting outlining exceptions, if any.

Is your FBO account reconciled?

We have found issues in the industry where FBO accounts go out of balanceA balance represents the financial status of an account, showing the difference between credits (deposits or income) and debits (withdrawals or expenses). There are two types of balance- actual and… More due to complexity in payments and settlementThe actual movement of funds from one financial institution to another that completes a transaction. More times. ReconSeer can balance your FBO balances and provide daily reporting that guarantees FBO balancing.

Network Recon

Can you reconcile to your networks?

- Mastercard

- VISA

- Pulse

- Greendot, etc.

ReconSeer ingests native network files and provides a transaction-by-transaction matching to provide proper reconciliation to network payments.

GL Recon

How do you reconcile your GL accounts?

Most GL recons require proper mapping and debits and credits to the correct accounts. Fintechs move money fast and in unique ways. ReconSeer automates your GL Recon and keeps it accurate, so you never have to make a single recon entry manually! No more journal entries!